How A Financial Services Company Used Utilization Study Data to Rightsize their Workplace

“We were thrilled with the results of the workspace utilization study conducted by Relogix. Their insights were truly valuable in helping us make important business decisions. By studying how we used our workspace, we were able to put together a compelling argument for downsizing our office space and ultimately saving money. We couldn’t have done it without the expertise of the team at Relogix, who made sure to keep employee satisfaction front and center throughout the process.” Director of Workplace Strategy and Planning

About the Company

Industry: Financial Services

Company Size: 281,160 sq ft

The Baseline

- Lease renewal in Q2 2024

- 1320 employees with an 8% growth trajectory over the next 3 years

- Desks and offices are 100% assigned

- Rentable cost per sq ft $65

Key Insights

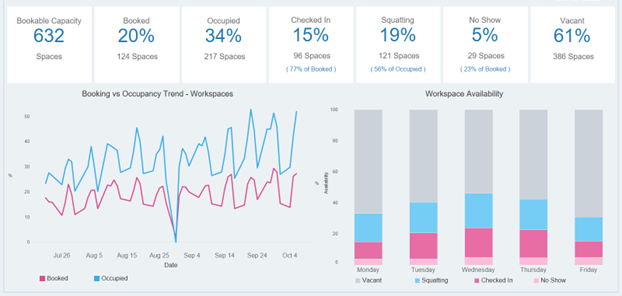

- On average, desks were occupied 55% of the time; and peak day occupancy never exceeded 63%. Average utilization was 42% with a peak utilization of 51%

- Offices were occupied 41% on average and 52% at peak. Average utilization for offices was 35% and at peak 47%

- Meeting Rooms and Collaboration areas were occupied on average 75% and 83% at peak. Meeting Room and Collaboration average utilization was 52% and 64% at peak

- The meeting and collaboration seats were only 25% occupied and 43% at peak (i.e., fullness of the rooms and areas)

Challenge

The financial services company faced the challenge of understanding the usage of its office space post-COVID so it could reduce its real estate footprint. While there was no formal mandate for employees to return to the office, it was communicated that employees should make an effort to visit the office 1–2 days a week whenever possible. The day-to-day management of days in the office was up to the team manager but the objective of team days was for collaboration and connection.

With their office lease being up for renewal in 2024, their goals are as follows:

- Rightsize the office — they want to quantify how much space they need to keep and how much they could comfortably exit when their lease comes due

- Optimize the remaining space which includes consolidating floors where possible, to re-energize the office

- Increase the amount of meeting and collaboration spaces available and ensure they meet the sizing requirements

- Future proof their plan to also account for planned future growth based on a 3-year plan

Solution

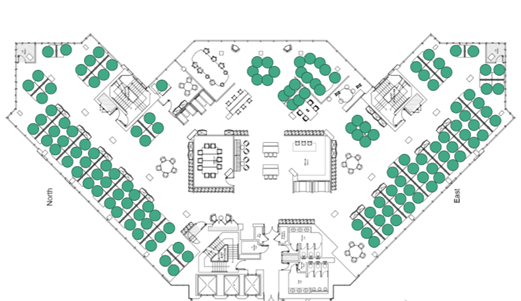

The financial services company installed battery-operated sensors and people counters supplied by Relogix in their workplace to anonymize data on employee behaviors in various work settings available including desks, private offices, meeting rooms, open collaboration areas, and support spaces like cafes and lounges where it was suspected that people were conducting informal meetings.

Workspace usage data — which included occupancy, utilization, and fullness — was captured every minute over 6 months, between 8 am and 5 pm, Monday to Friday only, and excluded holidays. The volume of data points collected each day provided a level of precision that enabled the company to make decisions with confidence.

Outcomes

The impartial data collected by the sensors installed enabled the company to:

- Identify an opportunity to reduce their costs with a potential to exit 8–10 floors leaving between 6 and 8 floors to accommodate current need and future growth

- Make decisions about the role of the office with high confidence, resulting in a cost avoidance of $45,000 and potential savings of $5.5M to $7.8M beyond 2024 by exiting 8–10 floors of their office footprint

- Increased the provisioning of meeting and collaboration seating by 30% to align with newer use

With this data, the financial services company will be able to improve the availability of meeting and collaboration spaces in their HQ to meet new post-pandemic demand and minimize wasted space. Room sizes will be adjusted to reflect new behaviors which included more private solo work with virtual participants.

They will also be able to re-energize the space by reducing the span of floors to make the space more inviting for people who came to work in the office, so it didn’t feel so unwelcoming and uninviting. The savings that were projected will allow them to budget for better technology tools to implement for their employees, improving the employee experience regardless of where they were working.

Finally, they will be able to use the key insights to guide their hybrid work policy and their office designs, and the associated workspace etiquette to align design intent with the insights gained regarding validated user behavior.