How To Kick Start The Best Workplace Strategy Using Space Utilization Data

Your lack of space utilization data is holding you hostage. Your workplace remains at a standstill, unable to move forward with any changes to the office that will be needed during and after the return to office (RTO) period.

You need good data to guide key workplace decisions. But without a critical mass of employees coming back to the office, traditional data sources aren’t that useful anymore. The kind of space utilization data you need today can’t be captured by those pre-pandemic methods: employee surveys, desk booking, security access badge data, etc. Even historical data, benchmarking data, and other baseline data has become irrelevant for guiding fundamental changes in the workplace going forward.

Workplace change is on the horizon—restrictions that kept us at home are relaxing, and everyone wants to get on with life. But work life is going to look very different in 2022 in comparison to 2019. Why and where people go to the office will be driven by new factors, like managing personal health and well-being.

We all know change can be an expensive proposition—but it doesn’t have to be, if we can dig in and really understand exactly what changes are necessary, and why.

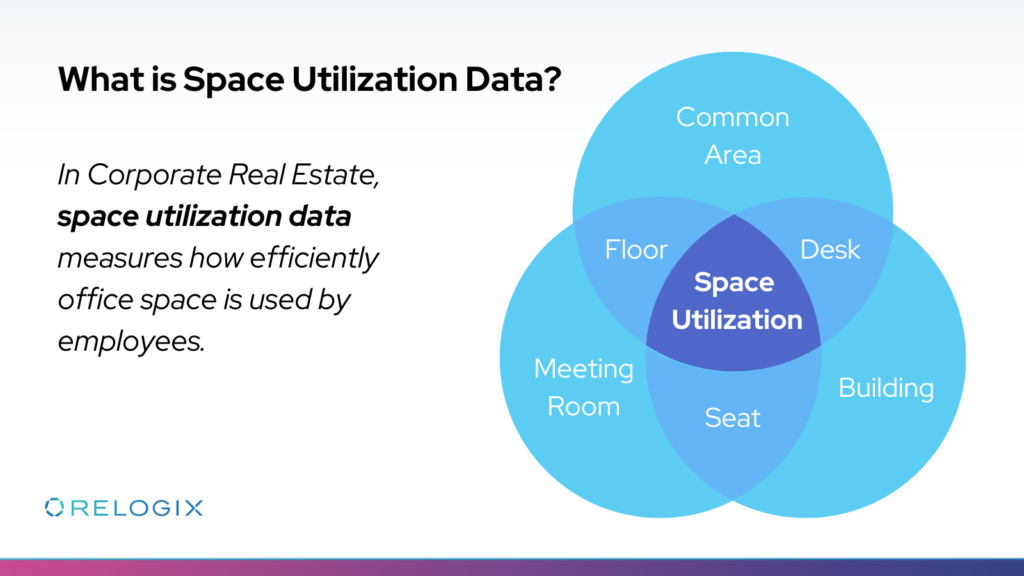

What is Space Utilization Data?

To get a grasp on where to go from here, we have to pin down the concept of space utilization.

In Corporate Real Estate (CRE), space utilization data measures how efficiently office space is used by employees. So, what do we mean by “space”? Is it the building, the floor, an area, a room, a specific seat? Depending on what you’re interested in measuring, it could mean any of these—and the way you capture and calculate it will vary, too. While some companies are interested in building or floor-level occupancy, which they can get from security access data, others are interested in areas, rooms, or even seat-level occupancy. This requires other methods for capturing the data to deliver the insights.

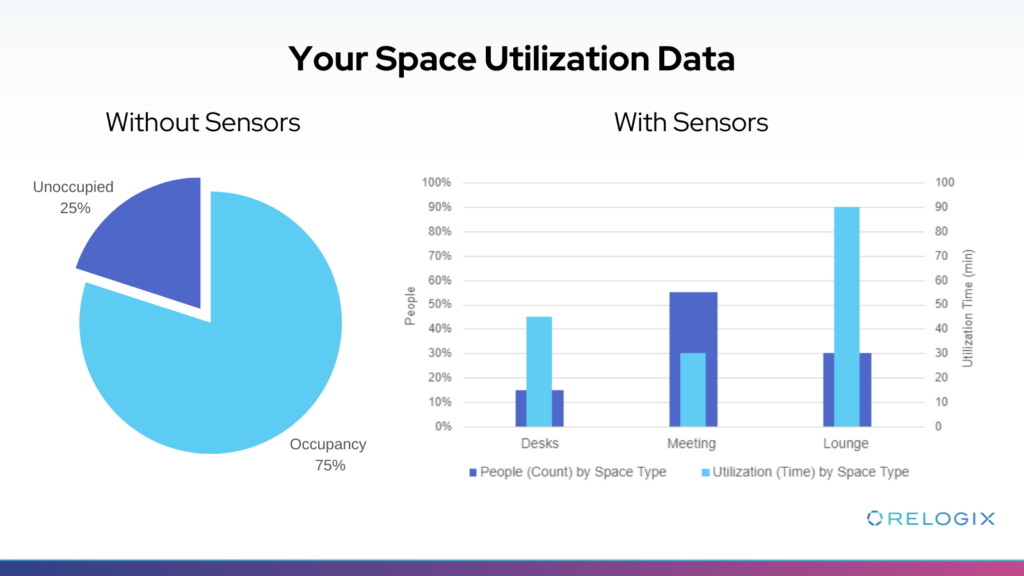

Before sensor technology was available, building (and floor) level occupancy was captured by security badge data. The terms “occupancy” and “space utilization” both meant the total occupants divided by total seat count. So, if you had 600 seats and 450 occupants, you’d have 75% space utilization.

If companies wanted to go deeper and get at area, room, or even seat-level occupancy, they needed a site observation study which involved taking manual attendance at regular intervals per day, usually over 2 or 3 weeks. Then, it’d be analyzed to produce a snapshot of how different spaces on the floors were being used over time. Space utilization data derived this way wasn’t totally accurate, but it was the best we could do at the time.

Sensors changed all that. The definition of occupancy didn’t change, but “space utilization” now means measuring how much time people spend in particular spaces. The badge data still provides information on attendance counts and the distribution of people among floors, and sensors enable further analysis, by providing more details about where people go when they’re on the floor.

Understanding space utilization at this level is a more reliable measure—sensors can capture how many people are in the spaces at precisely the same time.. Knowing all this provides a level of insight you need to begin to inform potential changes.

Starting Strong: Learning Occupants’ Behaviours

To understand what needs to change in the office, we first need to understand our employees’ behaviours. With this, we can start to make decisions that best align the office design (and furniture) with how people prefer to work. This way, we can provide more of what works, and reduce or eliminate what doesn’t.

To start, how do we know where to focus first? We can all agree it’s far too early to use this data to decide on things like getting rid of square footage or re-designing the entire workplace. Space optimization and square foot reduction strategies that yield huge cost savings are important—but aren’t the right place to start. The priority now is to use the data we have to encourage, support, and understand employee preferences as full-on RTO activities get underway.

The first underlying goal is to understand what sort of spaces work best, so we can work into our plans changes that might provide more spaces like it, and change spaces that are no longer necessary or preferred.

Out with the Old, in with the New: Sensors and People Counting

Early baselining and trending will be key in identifying what people want and what changes you may need to make. For example, you may want to understand what the new capacity planning requirements are, or what design changes and/or furniture changes are on the horizon. Doing this without the right data can be costly and disastrous.

Sensors and people-counting technologies are your best option for accessing early “micro” signals that illustrate the changes in how people are using the office since the pandemic started. This holds true, even if the data comes from just those few people who do return in the early days of RTO. Data captured from Relogix sensor technology can give you a granularity of detail that you can’t get from traditional data sources.

It’s also worth noting that one sensor technology can’t do it all, either. Different space types may require different sensor types to best capture the utilization of the space.

Ultimately, sensor data is the way forward. You need access to good data, and fast, to understand where people go when they’re in the office. There’s no better time than now to enable this kind of learning and get accurate insights in real time.

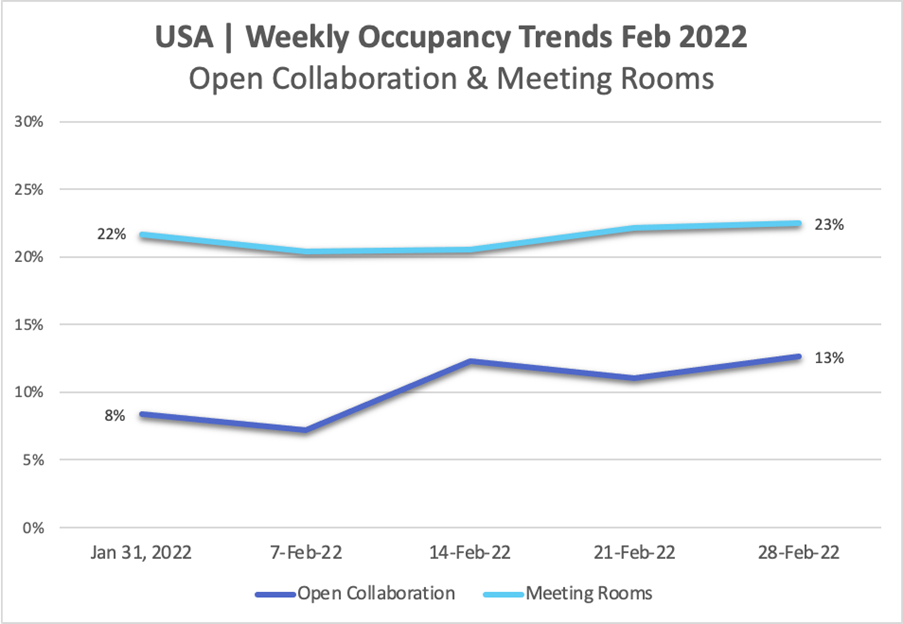

In the example below, we’ve extracted some micro-data from our own database of clients to show the value of sensor technology in making decisions about the workplace.

In this Weekly Occupancy Trending graph, we can see the output generated from sensors in a sampling of meeting rooms and open collaboration spaces. It shows us that the demand for meeting rooms has stayed fairly constant since the beginning of February, while demand for open collaboration spaces seems to be on the rise. Even though this graph only shows five weeks of space utilization data, we can already start to think of reasons for these trends. For example, people might have a preference for open collaboration spaces to have better control over their personal space, to maintain proper physical distancing.

The emerging trend here doesn’t necessarily mean that the meetings that are happening are less structured, i.e. more spontaneous than scheduled ones (although an integration with your room booking and calendar data can surely validate this!). Instead, these early trending insights serve to kick-start your design process. This behavioural data can help you qualify and quantify what parts of meeting and collaboration spaces might need changing, re-purposing, or re-designing, so your workplace can better align with what people need.

Getting into the Nitty Gritty: Using Sensor Data to its Fullest

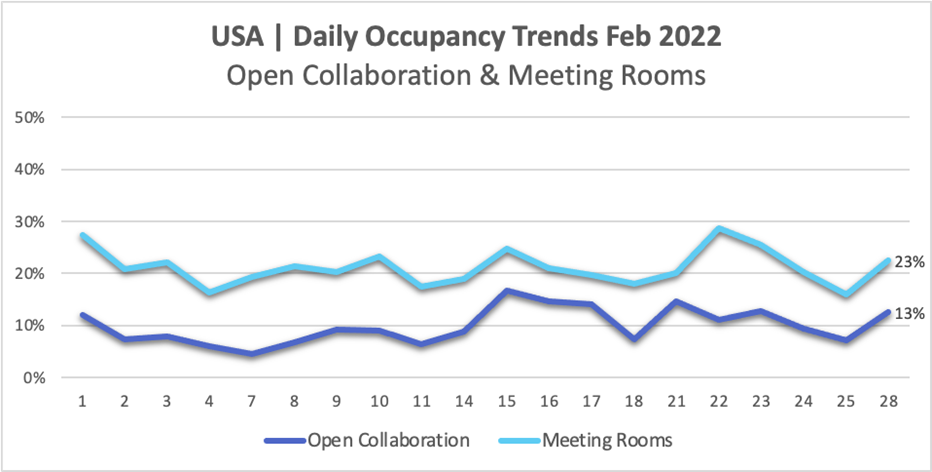

Space utilization trending data can be easily extracted using the right sensor CRE technology tool. It’s important to remember that data observations over short periods of time are highly volatile—when data is aggregated to a weekly or monthly view instead, you can start to see steadier, more reliable trending directions. Extremely granular data may not be enough to action anything right now, but it can still give us an idea of where we’re starting, and where the workplace might need to go in the future.

In the graph below, we’ve used the same data shown in the previous graph, but have expanded the month of February, to see what’s happening day-to-day. As you can see, it’s harder to see a trending direction for these two isolated space types.

But this data still provides immense value. For example, the daily view shown above tells us just how much the demand for space swings from one day to the next. We can see that meeting room space use has generally trended higher on a daily basis, when compared to open collaboration spaces. We can even see peak use occurrences for both space types, which gets lost in the rolled-up monthly aggregate view shown previously.

Seeing the same trends, but at this granular level, might change the way you approach your space planning objectives. More importantly, it highlights potential challenges you may have in effectively managing space availability and capacity, if space reduction is the ultimate goal.

Showing up at the office during the RTO period and not having a space to work that feels safe won’t go over well—but this granular data can help you dial-up your space availability to support demand, to make for a positive employee experience during this crucial time.

Using What You Have—Now

Having the right sensor technologies in place will give you access to the detailed data you need now to see new and emerging space use demands. Trending has been a confidence-builder in the past, and it’s no different now. The sooner you start trending the RTO activities, the easier it will be to determine where to focus your attention. Get ahead of what’s changing, how those changes are shifting workspace demands, and what this means compared to your current supply—after which you can start to plan adjustments accordingly.

Understanding this early on will guide key planning approaches that will eventually support factual decision making. Decisions based on reliable and factual data are more readily accepted and met with less resistance by those they effect. Now is the perfect time to use sensor data to inform and implement changes that are ultimately in the best interests of those using the workspace.