Let’s Get Real Episode 20: [WEBINAR] What Will the Facilities Management Industry Look Like in 1 Year?

Discussions on the Workplace and Corporate Real Estate Podcast

Some of the highlights of the show include:

- What was the pandemic like for Relogix, a workplace analytics organization, when offices emptied out around the world?

- The corporate real estate and facilities management industries are at an inflection point, with an uncertain future

- Organizations are concerned with how much space to shed and what design changes are required

- Since the pandemic, historical benchmark data is no longer useful—how do we forecast the demand and needs for space with so much uncertainty in front of us?

- Capturing live data is the key to finding the signal within the “noise” and keeping up with evolving workplace requirements

- Encouraging employees to return to the office requires a paradigm shift and a tremendous change management effort

- Who owns, or should own, the experience of work? HR, IT, facilities management?

- Elasticity or agility in real estate portfolios is going to be key going forward

- How do you collect data on how people work when they’re not in the office?

- There’s a lack of data scientists with corporate real estate knowledge in the industry—how do you convince data scientists to make the switch to corporate real estate?

- How do you deal with confusion surrounding terminology in the marketplace?

- Are employees actually on board with this massive shift towards hybrid work?

Links:

- Sandra Panara on LinkedIn – Director of Workplace Insights at Relogix

- Andrew Millar on LinkedIn – Founder and CEO of Relogix

- Mark Gilbreath on LinkedIn – Founder and CEO of LiquidSpace

- Convene – Collaboration-focused co-working space

If you liked today’s show, check out more episodes of the Let’s Get Real Podcast! This podcast is available on iTunes, Spotify and Google Podcasts.

Transcript

Sandra

Hey everyone, welcome to Let’s Get Real with Sandra and Friends, a workplace consortium podcast brought to you by Relogix. I’m excited to be sharing conversational musings about current events and how we envision the ever-changing world of work. I’m Sandra Panara, Director of Workplace Insights at Relogix. With 25 years of hands-on experience, I help value engineer global workplace portfolios and employee experiences by aligning workplace analytics with corporate real estate needs.

Have any questions, comments, or suggestions for future podcasts? Please drop me a line at [email protected].

Jillian

Hi everyone, welcome! We’re happy to have you here. My name is Jillian, and I will be your organizer for today. I’ll hand you over to Sandra.

Sandra

Thanks for joining us today, everyone. I’m excited to be speaking with our CEO today, Andrew Millar, about what’s happening in our workplaces and how the people behind the scenes like you are managing so much uncertainty and the uncertainty that still lies ahead.

Welcome, Andrew! Really happy to have you join me today. The past 2.5 years have been an incredible journey as the CEO and founder of Relogix, given the nature of our business. We’d love to hear your thoughts on what that experience was like.

Andrew

Thank you, Sandra, and thank you everybody for joining us today, it’s great to have you. I appreciate you taking some time out to share some experiences here with us at Relogix. We’ve been in the real estate technology game going on 15 years now, so we’ve seen an awful lot. I’ve seen an awful lot. But I must admit the last two years have been what we call quite the headwind for us.

Everybody on the call, I assume, is in corporate real estate, so I thought I’d just share my thoughts on the last couple years and what it was like. I was thinking about the story you’re going to tell 5 years down the road about how you got through the journey of being a real estate professional, and how you got through COVID. Someone might say to you, didn’t you work in the real estate industry? What was it like going through the pandemic? And I was thinking, ok, you’d start the story by telling them well, obviously the pandemic hit us and then all the offices, our core business, emptied out completely around the world. Everybody went home, and stayed home for almost two years.

During that time, on and on it went: the macro scene and economic instability, around the world stock markets are teetering, we’re dealing with massive inflation, and the price of everything has gone through the roof. We’ve got social unrest going on around the world, so we’re trying to struggle our way through that. You’re in real estate, so you might be trying to do some projects in your offices. We’re providing sensor technology, so we were all dealing with a global supply chain melt-down. Very difficult to get anything done, there’s no parts for anything, we continue on…we’ve got a war for talent raging, certainly in Canada, I’m sure around the world trying to find folks to join your team is rough. The price of talent, the price of folks is going through the roof, so there’s a war for talent’s going on.

And for sure, it’s just been one of those situations where absolutely everyone has struggled, but if you look at the corporate real estate and facilities management folks that are out there, no question that the commercial and corporate real estate industry has been disrupted. I think that’s a given. And it’s undeniable at this point that the industry is at an inflection point. And we can talk about that today. But the good news is, I think with the disruption comes lots of opportunity.

Sandra

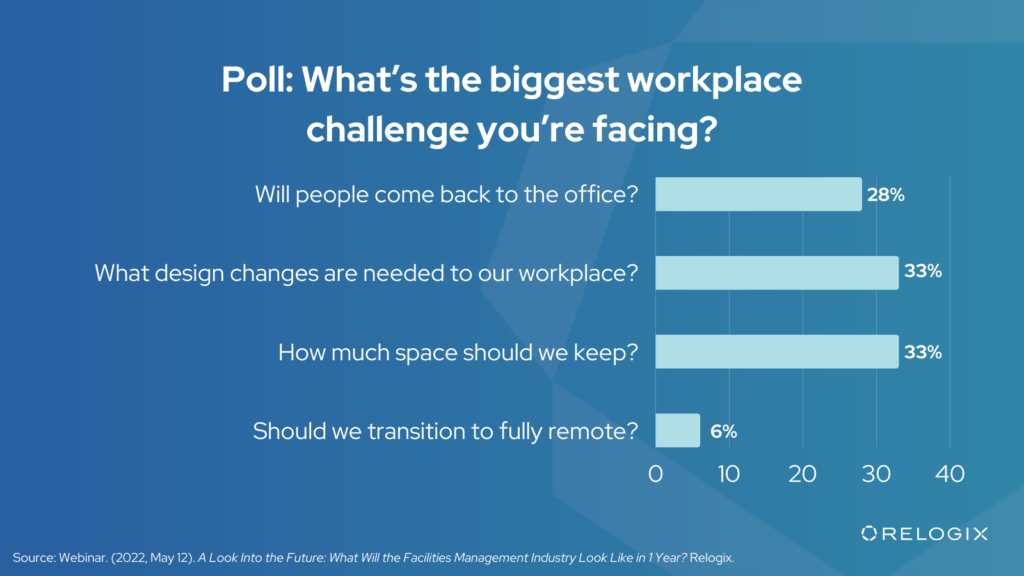

Let’s jump to a quick poll. With the uncertainty of what’s next, I’m curious to gauge where most of the interest lies within your organization with respect to some of the challenges that you’re facing. As you think about coming back to the office, what are the challenges that your organization is facing and trying to figure out? Is it figuring out how to incentivize people to come back to the office, maybe you’re looking at design changes that need to take place in the workplace because people aren’t using space the same way that they used to, or how much space you should keep if you have leases that are coming due? A lot of companies are thinking about that as well.

There’s also just the big question around, should the company be considering hybrid work or should they be looking to transition to being fully remote? These are all the things we’re hearing from organizations we’re speaking to, and it’s kind of all over the map with respect to where companies are putting their focus. There isn’t a clear focus much like there was before the pandemic, in terms of workplace optimization. So, I’m curious to hear what’s happening in your organization.

Interesting, so how much space we should keep and should we design the space are at the top, which are pretty much the areas where most of our customers are also playing. Obviously with leases coming due, or not coming due, people are realizing that there’s too much space. They’re asking themselves how much space they should actually be keeping and how they figure out how to do that. Then the flip side of that is actually just looking at the fact that, as I said before, the way people are interacting with space has changed. You may have allocated a bunch of desks and now people are coming back to the office, but they’re using a different type of space. A lot of companies are asking, what is the preferred space, do we have enough of that kind of space and what are the changes that we need to make?

Interestingly enough, there’s also the question, will people come back to the office? I think there’s a belief in a lot of organizations that there will still be people coming back in greater numbers that what we’re seeing right now. That’s basically a wait-and-see game, we don’t really know what the future holds. We’d love to be able to look into a crystal ball and see what that is, but it’s certainly not something that we’re able to do effectively with any data that we look at. It’s a huge unknown.

So having said all that, Andrew, thinking about all of these different things that are challenges to organizations, where do you see the market headed?

Andrew

From where I sit, the biggest challenge I’m seeing in the market right now, for our customers and people we’re working with globally, is this tremendous blind spot when it comes to the notion of return to office. I think what’s really interesting about that is, this is a global challenge that we’re facing, and every corporate real estate professional you talk to in the world is struggling with some of the very same things, which I find is really unique, in my career for sure. But it’s absolutely clear to me that we’re not sure how this is going to unfold in front of us, certainly for the next year.

We as a data company are always looking for historical patterns and pattern recognition, but as you know, Sandra, all that data we’ve had for many, many years, a lot of that is out the window. Those patterns are now irrelevant. Our lens is only looking forward, day by day, as this unfolds and we’re trying to figure out what’s going to happen next.

So, with this blind spot, the real estate leaders that we’re working with are struggling just to answer those basic questions. They’re asking the same set of questions, and how do you answer any of those questions with confidence without any data? Just the simplest things like, are people going to return? Who’s going to return? Where and how often? And then as you said, when they do return, what are they going to be doing in the office? What kind of work are they going to be doing, what spaces will they be using, how long are they going to be using those spaces, and what kind of space ultimately do we need as a result? We like to call that trying to understand peoples’ intent versus their actual behaviour. I think that’s really important to try to understand.

But the billion-dollar question is, how do we forecast demand and the needs of space with all of this uncertainty in front of us? And everybody is talking about trying to create a better employee experience, but how do you do that when you’re flying blind, and you don’t have the answers you need?

Sandra

Exactly. It’s interesting, you mentioned in a recent conversation of ours that during the pandemic, one of our customers was having a lot of conversations with us about booking systems, focusing on meeting and collaboration spaces. Some companies rushed to make changes to the space in anticipation of this change that was coming, and then it kind of fell flat. What was the outcome of that particular customer’s experience as a result?

Andrew

I characterize it as, everybody was stuck with one foot on the break, one foot on the gas, for the last 18 months. Now we’re all sort of saying ok, it’s over, let’s get going and make some decisions. People are trying to make decisions, making capital investments and changing space, buying tools and technology for a better workplace experience, like desk booking, visitor entry, people are investing in all sorts of solutions. Some of the reality is now that they’re 2 years into this game and people are still slowly coming back, they’re questioning whether or not those investments were the right investments to be making. Some of them were a little nervous that there were knee-jerk reactions. There’s going to be a lot of rightsizing and likely rationalization of space footprints across portfolios and if you made investments in some of them, it might be for naught.

Jillian

On that note, Brad Clark you have an interesting point to add to this. I’ll read off his questions here. He’s saying, exactly! Why do they really need to return? Why does the business or want/need them to return? What are the benefits? How do you navigate another culture shift to encourage on-site collaboration?

Andrew

Absolutely. I think we’re in a “work anywhere” world and we’ll talk about what that means today, but it’s pretty absolute that the makeup of the office has changed. A lot of our customers, from what we’re seeing, are really opening the doors and now wondering, how come occupancy is not increasing as we thought? We set a target, it’s not happening, now what do we do? And that’s it. We’ve got a lot of clients that are looking at us saying, we’re working on what we’re going to do next, but the data is not unfolding the way we had thought. And it’s a big part of the question.

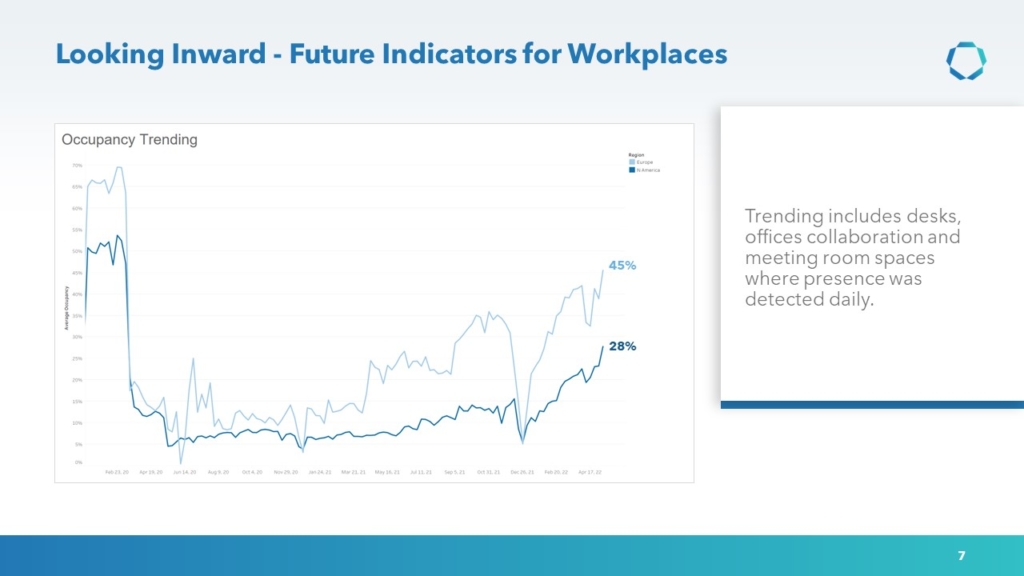

If you look at this graph here, this is really interesting for Relogix. We’ve been in a very interesting position over the last couple of years, as a data company. We’re sitting there watching the patterns of data unfold globally from all the portfolios we’re studying. It puts us in a very interesting position to watch it, and we’ve been watching it obviously continuously.

This graph is the last couple years. It’s showing UK and North America as the dark line. So, you’re on the internet, you’re reading all of what you might call the “noise” that’s out there right now. Everybody’s got an opinion of what’s going to happen next, but we have the opportunity to find the signal within the noise. Because we’re looking at the numbers and the data that’s unfolding, capturing live occupancy data in real offices around the world. We’ve been doing that for the last five years, so we have quite a pattern.

And then the last couple of years, as the graph shows, that line is obviously pretty spiky. And now today when you look at those numbers, there’s no question that certainly in North America, we’re still not seeing even close to 50% overall occupancy. Over all these years, Relogix has been screaming from the rooftops that offices have sat empty around the world pretty much in the best of times. And that’s just the reality of it. We’re trying to convince folks to be more effective with how they use space. And if the world sits at 28% or below, and this continues, there’s no question: this part has been disrupted and it’s going to be interesting to see where we go next.

Sandra

I think what’s interesting about this too is, when you look at a graph like this, there’s the temptation to look at the past and try to predict the future, to say, it’s great that we’re starting to see the incline, we can sort of predict what the future might potentially look like. But that’s not necessarily true in the market that exists today, because it changes literally from week to week, month to month. There’s something that happens that’s COVID related, or some other thing that’s happening, you’ll see a significant dip in the numbers and then it almost feels like every time there’s a dip, there’s a bit of an erosion to the confidence level of the actual return. Well, what’s the point of even bothering to go back? So, that basically results in this jagged line that we’re seeing.

The other part is just the nature of the line and the fact that it’s demonstrating volatility. We’re basically looking for it to flatline. Once it starts to flatline, that’s where we can start to say, ok, that’s what the new normal is. We have absolutely no way of predicting at what point it’s going to flatline. Because it’s completely at the mercy of the employees.

To the point of companies trying to figure out how to bring people back, we’ve seen in the news that some companies are trying to mandate and put their foot down and say, you need to come back to the office on specific days. Employees just are not having it. They’re just not interested in mandates. That’s what makes this really unique, and hard to really predict what’s going to happen in the future going forward.

Jillian

We have another question here from Andy.

Andy

Hi! When you talk about change management and how to get people back to the office, you’re coming from a different paradigm. It used to be that everyone was in the office and becoming an activity-based worker was a change but now, everyone’s home, they’ve been home for 2 years and they’ve adjusted their lives to it. So, changing that paradigm mix is now what you’re coming up against. And it’s a different dynamic. I don’t think that a lot of organizations understand the full impact of how hard that is, unless they’ve gone through activity-based work incorporations or things like that in the past.

Andrew

No kidding, a tremendous change management exercise is going to be going on for the next year for all of us. No question.

Sandra

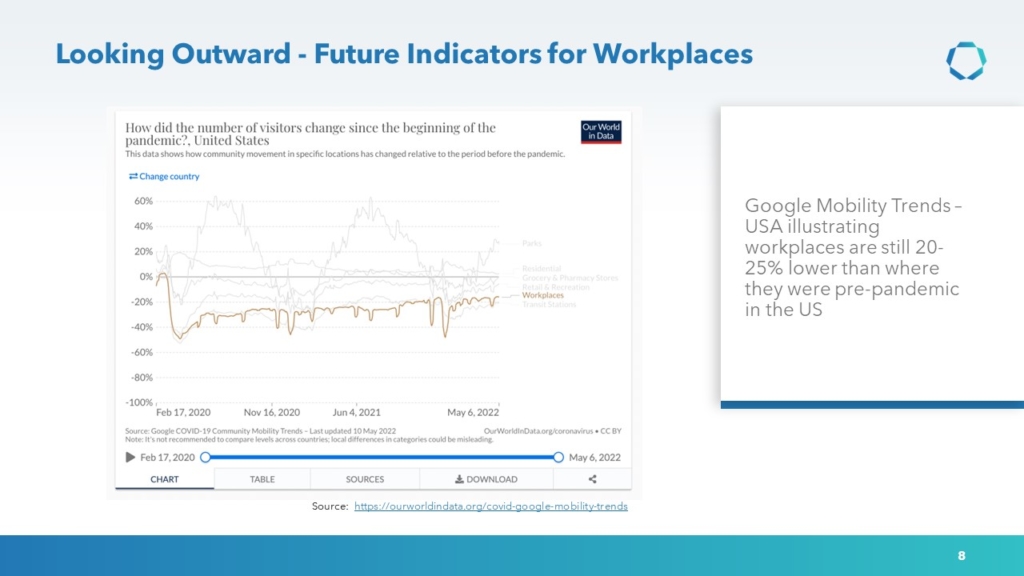

Just to add to that previous slide, this is a graph that I pulled down, it’s showing Google mobility trends. They’ve been tracking this information since the onset of the pandemic based on whatever that baseline was with respect to people transitioning or going to the workplaces. Obviously, Google’s smart enough to know if you’re at home or if you’re out shopping or if you’re in a workplace setting. And what’s interesting about this is the drop-off rates. We all have heard, if you’ve been in workplace strategy, what real occupancy numbers looked like before the pandemic. 50 to 60% was the norm. Some companies got up to 70% but it was very rarer to see anything over 70%. So, when you look at the onset of the pandemic, with that drop-off of 40, 50%, you’re looking at potentially the fact that you had skeleton staff in the office, so maybe 5, 10% of the people. We saw that as we were watching the mass exodus happen in other parts of the world before it hit North America.

But what’s interesting is, when you start to look at the incline as people are starting to come back to the office, you’re still about 25 to 30% away from whatever that baseline was before. So again, using that 50, 60% proper occupancy rate before the pandemic, subtract 30%, you’re probably at about 20%, in terms of the rate of return. As I was flipping through the different countries, the only one that actually showed a steep incline was India. All the other countries were pretty well flatlined. So, there’s really very little movement with respect to people going to the workplace and being captured from mobile devices. This is fascinating to me because maybe this is an indicator of the fact that it is steadying out and it has been over the last couple of months or at least the last couple of quarters.

Andrew

Sandra, a lot of your podcast I’ve heard you talk about separation of “work” and “place”. Maybe share a little bit about the employee experience side of that or what are you meaning when you’re talking about that?

Sandra

It’s not necessarily focused on the employee experience per se, because that’s a pretty loaded topic in itself. It’s more about being more generic about what the experience of work is, and thinking about who actually owns that now. Before, you always had HR, IT, facilities management, and a whole bunch of other roles that were tapping into building this experience of work when you physically had a workplace. But obviously there are growing roles and responsibilities within the organization around this thing.

There’s also a little bit of an ego situation happening, where everybody wants to be a hero. So, you’ve got HR that basically says it’s about culture and wellness, from that HR slant. Then you have IT, which is all about the technology, so you’ve got workplace technology and all of these new requirements where you’re trying to get at data as it relates to the actual space itself. And then facilities management, which is sort of all encompassing, depending on the structure of the organization, about space planning and preparing for the maintenance requirements as people are coming back to the office. There are so many moving parts to all of this. And often, these teams are competing for the same budget.

The bottom line is that there’s business to be done. Business requirements are what they are. And whatever it is that that experience needs to be, everybody needs to get on the same page. It’s not an HR initiative or an IT initiative, or corporate real estate initiative. It really should be one that is a joint initiative, as an organization, so that you get that cohesion and, more importantly, the alignment around what you want the experience of work to be, for your employees. Is it in the office? Is it out of the office? Is it a hybrid solution? How does that all work? I think the whole concept of managing is going to become that much more complex because of the volatility.

As we said before, we don’t really know what the future holds, and so companies are kind of in a hold state right now. They’re toying with the idea of hybrid, and there’s already a bunch of challenges that are coming through with that just because it can’t really be scheduled. If it’s true hybrid, you’re not going down that scheduling path. So, it doesn’t work for people. It creates mayhem for corporate real estate, for facilities management when you’ve got companies like Apple that are mandating the specific days that employees are coming in. You’re basically putting a lot of emphasis, and a lot of demand on space in just a few days in the week. Whereas if you left it more open-ended, you would have a greater distribution across the five days of the week.

So there’s all these puts and takes as it relates to how you’re going to shape the experience of work going forward. What’s interesting in all of this is how the role of the experience has not necessarily changed, but it’s becoming more and more distributed.

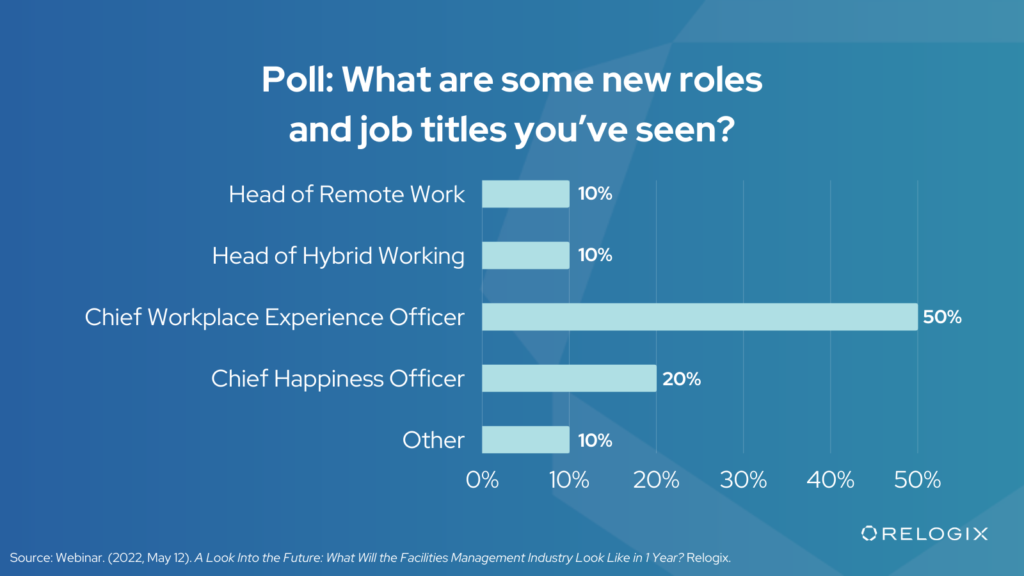

One of the things that we’ve seen quite a bit over the last little while is these new titles that are emerging. We’re going to do another poll now, curious to know if these new roles have been created within your organization. Because what we’re starting to see more and more is that the whole role of the experience is being pushed off to a new title, but in reality, it’s not about a new title. It’s about the cohesiveness of the team and working together to establish what that experience needs to be and then working on that experience in a joint fashion.

I’m curious to see the results of this one.

Jillian

We’ll just give it a couple minutes, but in the meantime, have you seen any of these titles yourselves in some of the conversations that you’ve had?

Andrew

Yes, I’m certainly seeing a lot of Experience Officer—the word “experience” in titles right now is popping up for me all the time.

Sandra

I think the other important question too is under what umbrella does that role fall and who does it report to? Is it part of real estate? Is it part of IT? Is it part of HR? There’s massive confusion as to who actually owns the experience, and the expectations around that, I think more than anything. What does that mean exactly?

Interesting. I wondered, when I started to see this emerge and was looking at the job functions—is this a workplace strategy role renamed? Because I think a lot of the roles and responsibilities for the Chief Workplace Officer really includes many of those objectives. It almost feels like it’s a modernization of workplace strategy. It feels very place-focused versus experience, although the word workplace again is a bit of a touchy subject, but we won’t go there.

Alright, now we’ve understood the emerging problems, and the fact that we’re not really sure who owns ultimately the experience. We also know that solutioning never really starts with tools—so Andrew, what would you say are some of the emerging problems as a result of this confusion that’s happening in the market?

Andrew

No shortage of challenges out there for us, folks. I would say that it’s undeniable that we’re in a

“work anywhere” world, we like to say. Actually, a friend of ours, Mark Gilbreath over at LiquidSpace, he coined it “the trillion-dollar dumpster fire” that’s going on in commercial real estate. I thought that was a little heavy, I’d call it “the Great Re-alignment” rather than dumpster fire, but no question, offices are not going to disappear any time soon. It’s the biggest SaaS class in the world, so it’s by no means going away.

But I believe it’s absolutely certain that we’re going to have a percentage of people working from home permanently. I don’t think that anyone’s going to deny that that’s a fact we’re going to be dealing with. But I also firmly believe that a percentage of folks are going to be working at third places. Co-working spaces, coffee shops of the world, all the other restaurants becoming co-working spaces, a percentage of folks are going to be always in those types of spaces as well.

And I think what we’re going to see is that companies really need more elasticity in their portfolios moving forward. That’s the key, that agility or elasticity. Because we’re going to have to figure out how to deal with these ebbs and flows of the supply and demand equation. The only way to do it effectively is to realize we’re not going to be in our leases forever, we’re going to have to have an elastic portion of our portfolio until this thing starts to balance out. There’s no other way to deal with it.

That, to me, speaks to the need for more real estate as a service. I think that part of our world is going to continue to increase, to deal again with that ebb and flow. The challenge of that realignment for corporate real estate and facilities management is that we’re the ones that have to try to figure out, using whatever data and tools we have, what pattern is going to unfold in front of us. And we have to make strategic decisions about our portfolio based on not the best data at the moment.

So, the challenge is really, what data do you collect, and how do you collect the data that you’re going to need to make informed decisions in a work anywhere world? And how do you collect data around how people are working when portions of them are working from home? Portions of them are working in third places? Data privacy is heightened more so than it ever has been, so for us to capture that data—it’s really, really tricky to do. And we still struggle with how we’re going to capture any data from the folks that are not in our office. Those patterns for us are really the key to understanding what’s going to unfold, so we have to find ways to be gathering any day that we can get our hands on, and how do we improve?

We were talking about how to improve the experience of work when you don’t have the data to even effect the common decisions that you need within the workplace? That puts us really in uncharted territories, as far as I’m concerned.

Sandra

I know before the pandemic, a lot of the drivers with respect to optimizing the workplace stemmed from cost-savings. Companies were all about cost-savings. Do you see cost-savings still being a key driver, or has that become secondary?

Andrew

I think it’s the secondary equation right now. It’s falling out the backside of us, just trying to understand, again, the patterns of work right now. We’re going to spend the next years figuring out the patterns of work. Most organizations are shedding space. But we’re stuck before we can make any kind of rationalization, rightsizing decisions across the portfolio. We’re still waiting, hesitating to see what our occupancy is going to be looking like and in what cities and parts of our portfolio, what cultures, what departments, what organizations. You’re going to definitely see that rightsizing coming but it’s not the immediate focus. You’re focused on that experience piece first, to then inform the right optimization program, coming out the back of it.

I threw this one in for you, Sandra, because someone said to me, “data’s the new oil”. We’re a data company so we think a lot about it but, with the price of gas right now, oil’s just not cool. Nobody likes oil. Data’s maybe the new bacon, and we’re Canadian so I thought that was kind of funny.

Sandra

Very appropriate!

Andrew

To finish my thought, I’m sorry to say everybody out there that you’ve got a challenge in front of you. So, if we all believe data’s the new bacon, corporate real estate and facilities management are going to struggle, because what we need is more data analysts, data engineers, and data scientists. I know, after being in this business for so many years, finding those folks is a huge challenge. Finding those folks who know even how to spell CRE is a massive challenge. We’re trying to hire and recruit all the time, and I hate to say it, but corporate real estate and facilities management are not the coolest kids on the block, when it comes to tech.

It’s about trying to convince folks to shift their career out of some other area like finance, IT, other areas where data scientists and engineers live and get them to come over into our universe and focus a part of their career on figuring out corporate real estate—it’s a real hard lift. My recommendations right now is to be looking at intermediate level and other folks maybe popping out of school. And then you’re going to have to do upskilling and train them up. Give them subject matter expertise. Just having expertise around data, without the context of our business and how it works, is very difficult. You don’t get a lot of value out of the data if you don’t understand the industry and the context. A massive challenge for all of us ahead, is going to be talent.

Sandra

That’s an astute point. I’ve worked with many companies in the past before I joined Relogix, where they had a business analyst or a data analyst that was in IT without any corporate real estate background. They could put visualisations together fairly easily if they had the resources to do it, but then the million-dollar question was, well what does this all mean? There was no interpretation of the data, which is where it kind of fell apart. And I’ve seen that, time and time again—unless you have someone that knows the significance of the data, who can look at a graph you know exactly what it’s telling you, it’s very hard when you’re asking someone in a completely different field to do visualizations. It’s hard to really give it the context that it needs so that you can make the decisions that need to be made.

Jillian

We have a question here again from Andy. Did you want to unmute yourself and ask your question?

Andy

Sure! Given that all our work is really based on the computer interface now, that provides us an opportunity to actually get data around how people work. What software are you using, how long they’re on it, if they’re on Teams meetings all the time, all that kind of stuff. And I know that Microsoft analytics and probably Google analytics and probably every single platform out there has it, but it’s always an issue of access and security, to your earlier point Andrew. Are you seeing any availability or access, especially in creating a streamlined dashboard that you could then give insights on a quarterly or bi-annual basis?

Andrew

Great question, and absolutely. Coming from and starting in the IT community, who has already been tapping that data to understand just how systems are used and you know, it’s a corporate asset. The data belongs to the corporation, and we should be able to understand how people are using the corporate assets. The data stream is one of those really tricky ones where it could easily turn into, well, are they tracking me? And yes, we can tap into some of that data, but you have to be very cautious how you communicate exactly why there are sensors, what the data’s going to be used for, and how it’s going to be used. But it’s early days. Very few people are crossing over and figuring that out, because it’s very Big Brother. So, it’s a tricky one.

Sandra

I think personally that the value in that kind of stuff is still forthcoming. It’s more about understanding relationships of people that work together. If you think back on when you were doing site observation studies, you always ask the question about adjacencies. You’d go out and try to understand who works with whom by just asking the question. And in talking to other people, some that are a little bit further along in their analysis, you don’t have to ask the question. And often there’s a discrepancy. You might think that you need to be next to the marketing department, but in reality, you rarely work with the marketing department because you’re working with other teams, which comes through in that type of data.

We have a couple of customers who are edge cases and are exploring that. We’re saying, ok, what are the relationships or the frequencies of people that work together coming into the office? Are they on the same teams or different teams? We’re looking for patterns to really illustrate potentially what those work relationships are. But again, it’s still very much focused on the office space right now. The independent work is one thing, but I think where the interest really lies is around the collaboration and the collaboration disassociated with the physical space. It’s about saying ok, if I’ve got 2 or 3 people that need to work together, how do we ensure that they are aware of their individual needs, but also their teaming needs, and where work should happen, where it works for all of them. It’s not about mandating days in the office. Maybe if that’s the only option that’s made available, great. But if there are other options, like this particular company considering co-working, then that opens up a whole new door for employees to think about how they want to work together on the days that they choose to be together.

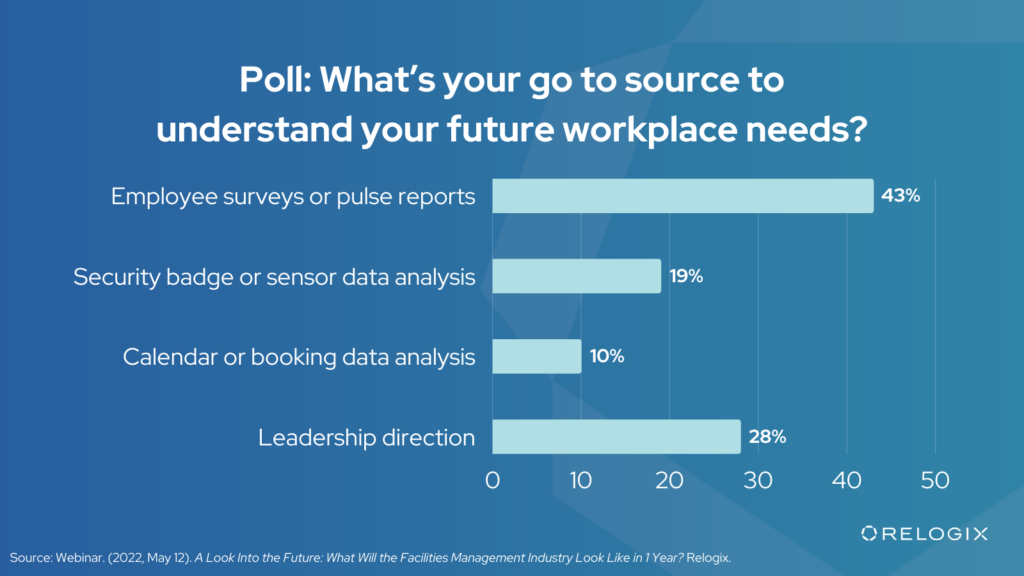

We’re going to do another survey: what is your current go-to data source to understand your future workplace needs?

We know that a lot of the data sources that you used to go to before aren’t really useful anymore. We can’t be looking for benchmarking information from the past because that’s all out the window. So how are you capturing that information today? What are your sources?

We’ve had several conversations with customers around badge data and the value that this brings. A lot of companies think that badge data is useless, for lack of a better word. But the reality is that badge data is, and continues to be, the first source of at least trying to gauge how many people are actually coming in. With badge data, you can probably get about 75% accuracy. Because you’ve got tailgating, you’ve got other things that come up, but that 75% accuracy rate might be pretty good if you don’t have any way of looking at data today or any data source today. It’s a great starting point.

So, if you know that you’ve got only 50% of your people coming in, maybe you tack on another 20% just to be safe. That right away gives you a 30% opportunity. And you’re not really impacting the employees’ experience in any way, you’re just getting rid of space that people are not actually using. And that’s usually where companies start going down that data journey. You start with the highest possible number and then you just continue to drill into the data as more and more questions start to emerge. For example, once you know how many people are in, then you ask, what floors did they go it? Then it’s what spaces did they go to? And so on and so forth. There’s a bit of a journey that happens there.

Well, this is interesting. Employee surveys has been a really big one over the pandemic to check in on a number of different factors, primarily their willingness or their desire to return to the office. So that one’s not surprising.

Leadership direction, again, not surprising in terms of turning to the leadership about what the future of the organization is and how they envision how the organization is going to function going forward. That’s going to be a requirement because you want to ensure that you’re aligning with whatever that leadership’s direction is, good or bad. I mean, that’s ultimately what you’re trying to do. However, interestingly enough, from my experience there’s leadership direction based on gut feel, and then there’s leadership direction that’s driven by data. So, when you have data that’s helping the leadership make the decision about what the right direction is, that’s when you actually have the greatest success. If you can go to your leadership team and say, hey, you guys are thinking about doing fully remote, as an example. But the reality is, 40% of our population still want to use the office. How do we address that?

The flip side of that would be a similar argument. That’s when you would turn to your security, your sensor data, your calendar data to get a sense of how many people actually are coming in to be able to gauge where you’re in terms of what the direction is. So, there are a series of validation steps that you need to take. It’s not a one and done.

That’s one of the things that I think is the biggest takeaway of COVID. What we’re seeing is that before the pandemic, many organizations would do their 3-year retrofit projects, they would come in, do a study, get the information, do the plan, and then move forward. Now, there’s a need for ongoing analysis and data because things could be shifting at any point in time. Not only does that mean that you may need to shift your plan, but you want to be using that information as indicators to tell you when something’s happening in the business, rather than waiting until it’s too late. Then you then have to react, instead of getting in front of it.

As Andrew was saying before, if there are other options that you’re considering to ensuring that your organization has agility with regards to space, so when you have a greater number of people coming in, how do you deal with that? Do we just take on the space and let it sit idle for the 80% of the time that we don’t use it? Or do we look to a partnership with, for example, a co-working space to fill in the gaps? These are all part and parcel of this decision that needs to be made around the workplace.

Andrew

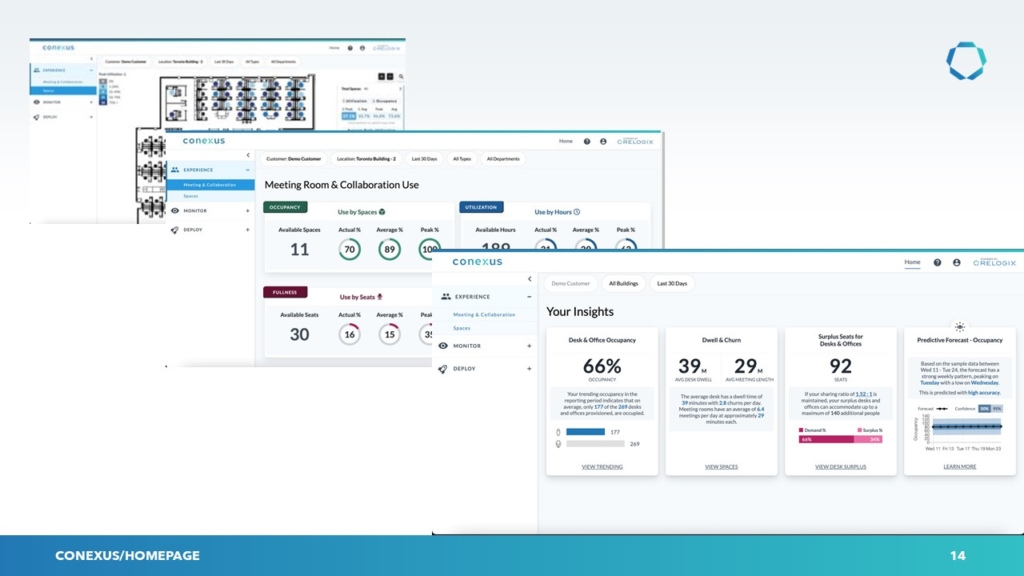

Where does Relogix fit into the picture? I’ll just tee that up here. We are a data company, we’ve been in the business here for 10 years, working with corporate real estate organizations. We’re definitely the leader in what we call workplace analytics, and our platform is called Conexus. What we do is ingest all the meaningful data across facilities management and corporate real estate into the Conexus platform to help our customers make informed real estate decisions. And that means sensor data, badging data, booking data, WFMS data, whatever data a customer might have.

Conexus and our team is about pulling that data together and turning it into meaningful insights. Our sensor platform is in the industry a do it yourself, easy to deploy, high agility, easy to move around solution that allows you to collect really tight data on short notice.

I’ll also point out one really exciting thing we’re working on right now, on the bottom right you’ll see a card that says “Predictive Analytics”. We’ve actually filed recently a new patent in the area of AI machine learning, and it’s our ability to look forward and actually with the data patterns that are unfolding, be able to predict what the future pattern for occupancy will be, based on the data that’s coming in in real time across the portfolio. So actually having the ability to predict and then prescribe, based on new techniques and AI machine learning. So, super cool to be able to predict the future.

Sandra

That’s exciting!

Andrew

We’ll use the last 10 minutes to answer any questions anybody might have.

Jillian

Brad if you’re still with us, did you want to explain your response to the survey, about your data sources? Brad actually mentioned that his go-to source was “all of the above”. So maybe you guys can kind of speak to that and people who have to use multiple sources, use all of the above?

Andrew

All of the above data sources is very unique and there are very few folks out there in the industry that are able to pull together all those data sources. You’ve got to get them all together and put them in one place, but then do the work to transform that into assertions about occupancy and tease out the insights that come from the correlation of all of those data sources. That’s the heavy lifting, for sure, in our industry.

I like to say every organization we work with is like a snowflake. What I mean by that is you walk in the door and you have people on a data journey. Some have very little data and they’re at the beginning of their journey and trying to figure things out, whereas some companies have been at it for 10 years and they have really rich and powerful data. We’re the ones that arrive and try to deal with what we have in front of us, and make sense out of the fidelity of that data and the precision that it provides. So, seeing it across the entire industry and all our customers makes it really powerful to know how we can zoom in and zoom out of the portfolio, just based on the various data sources that are available. But Brad, if you managed to pull it all together, you’re on the data journey and very on the mature end of the pendulum versus a whole lot of the rest of us out here in corporate real estate.

Sandra

To that point too, and probably Brad can attest to this, is the amount of time that it takes to do that. Having been on the other side of the table, and doing that myself, it’s pretty time-intensive to do. The key is to set it up where you have a continuous feed, because the last thing that you want to be doing is spending weeks on end building that out to get to an answer, only to realize that some things changed in the business, your leadership team decided that they’re going to go in a different direction that brings you right back to the drawing board. This has been a very, very common occurrence within the corporate real estate teams.

Jillian

Theresa Chang, I see you have your hand up. Did you have a question you wanted to ask the group?

Theresa

Yes, hi to the team! I find your stuff really interesting but I had one question. What is the influence of furniture suppliers on what is happening in the future? Because obviously, they’re saying things will be more collaborative, and this is good for their pockets of course but it’s not an easy change. Furniture is not that easy to change, and if you’re rightsizing, then you might have the opportunity. But a lot of the discourse about the future of work is sort of related to, I would say, a vested interest. How does that show up in how you are seeing the true research of what happens in corporate real estate?

Andrew

I can lean in on that one a little bit. I guess the reality now is that you can be extremely objective about what furniture settings are actually working for your team and which ones are not. And we’ve done enough of that work and data-driven design that it’s not anecdotal anymore. We can definitely show very clearly which furniture settings are getting the most traction and which buildings on which floors by which groups. And the good news is, we can ideally have some flexibility.

I dreamt of a Furniture-as-a-Service world as a result because everything for me is as-a-service. Could we get the furniture providers to have that agility to swap out the furniture settings that are not working until you find the sweet spot of what’s good and what’s bad? Or, not good and bad, sorry, but what’s working and what’s not working. It’s pretty obvious if the settings are not being used. Then ideally you would want to change that.

You see a lot of capital projects where the work gets done based on what we think is the right strategy and plan, and then all the capital was spent, and it’s difficult at that point to make any changes, because you’ve already made your decisions and you’re stuck with underperforming spaces as a result. And the data shows it and it’s not easy to deal with it at that point.

Sandra

I think what’s interesting too about that is, if you think about the evolution of facilities management, we started out years ago moving furniture when you moved. So if you had a re-organization, you’re dismantling furniture and re-building. And then you kind of realized this is ridiculous, and then we went to box-moves. The furniture is fixed, you just move people around. But you’re always within the facility.

Then we went through the whole activity-based work where you tried to do these different furniture settings, again very much driven by the furniture industry in terms of this idea of having people move around, always within the workplace space. But now, there are these different, very focused co-working spaces that are popping up, like Convene for example, which is collaboration spaces for the most part. So, why not, when there’s a requirement for a meeting space, you go to the space-as-a-service provider where you don’t have to invest in the furniture, but you know that the purpose for going to that space is to have meetings, versus going to a different type of space where the focus is on something completely different. And so, again, it’s a completely different way of thinking about how you use space, but because it transcends what we think of when we think about the workplace being just one central office location or network of office locations.

Jillian

We have another question here from Tawanda. I’ll read off her comment. Her comment was, the government has reduced footprint in prior years as a mandate. Now we have smaller offices and small workspaces. The anxiety is high for employees, as many are not interested in desk sharing. This is the wave of the future, post-pandemic. Also, because of this, there has been a great exodus. Data analysis employment is appealing because we know that this can be worked on from home.

Andrew

Definitely a good point for sure. The way I look at it, the 5 years we worked before COVID, flexible, activity-based working, all that was still a very slow-moving train. What percentage of the world’s portfolio was fully unassigned flexible seating environments? I bet the percentage was less than 5% probably on the whole globe. Guess what? Now the door blows wide open and everyone’s trying to move to unassigned at a rapid pace. And what about the people? They weren’t really totally onboard. Corporate real estate had to sell that dream to the business before and now here we are, and it’s upon us. What about the people?

Sandra

I think the other part to that too is, she’s talking about people not being interested in desk sharing and the fact that years ago, there was this whole thing of increasing density in the offices, which was a way of cramming as many people as you possibly could so that you didn’t have to expand on real estate. This now works a little bit against you because you’re already in tight quarters.

But if you think about it from a different angle, you can have desk sharing in a scenario where you have a 200 square feet per person scenario. The footprint is a separate argument from desk sharing. Desk sharing is just, if we currently have 50% of our people coming in to the office, that means you could have a 2:1 sharing ratio, that doesn’t mean that on the same day two people are sharing a desk. It’s just that based on the behaviours you’re observing, you allocate a certain number of desks that get used by people so that you’re optimizing how your physical space is being used.

I know for certain that there’s confusion in the marketplace around the terminology. You had hotdesking, that sort of blends into desk-sharing and peoples’ perceptions of what that means. And then people get really standoffish about it. And of course, there’s the aspect of COVID germs, which again is very real. It’s not something that’s favourable to most people. But companies that have done it have figured out how to deal with the changing of the hands, if you will, of people that are using desks, and it works. And so, the key is that you don’t want to be following trends. Every company has their own objective, their own way of how they want their businesses to operate, and the clues of how you should be operating really come through your data. If you’re looking at your data, your data’s telling you the direction that you probably should take, if you listen to it. If you choose to go your own direction, then the outcomes are going to be what they will be.

Andrew

Well, thank you very much everybody who’s taken the time out, we value your time, it’s precious. I hope you picked up a few nuggets here along the way. By all means, follow up with Sandra or myself or anyone here at Relogix, we’re happy to chat further and answer your questions.

Sandra

Thank you, everyone!